It may help before you begin to review my presentation Divorce Basics. The basics give you some of the foundation background to divorce in general. This presentation assumes you already know what issues are included in a divorce.

I lay out for you some best practices for putting together your divorce agreement. This guide is meant to be used in conjunction with filling out your Client Report and the goal of this guide is to make sure you give your lawyer the right information to put together your Divorce Decree.

The advice is broken down into Recommendations and Assumptions.

Recommendations are the methods we recommend you use to come up with the terms of your divorce agreement. For example, we recommend that whoever receives a car in a divorce also should pay the loan on the car, if any.

Assumptions are the implicit assumptions we make in regards to the court orders around your divorce agreement. For example, we assume that if your spouse is awarded a car in the divorce and the car has a loan in both your names that your spouse will refinance the loan to remove you from liability.

I strongly encourage that you follow our Recommendations and to not make agreements that violate our Assumptions. As a practicing lawyer, I know that people live different lives and are infinitely creative in the arrangements they make in marriage and in divorce. But I also have been around long enough to know what works and what doesn’t.

Don’t be creative. The law does not reward novelty. If you choose to make your own path you do so at your own peril. Many novel ideas do not work out. I know because I see those people back in my office and back in court. I suggest that you stick to the tried and true methods laid out in this presentation to ensure you make the best divorce agreement that you can.

Divorce Decree

The goal here is to put together information that can be easily used to put together a strong, smart and enforceable Divorce Decree.

The Sections Below deal with:

- Property Division

- Vehicles, Bank Accounts, and Personal Property

- Real Estate

- Retirements

- Debts

- Alimony

- Child Issues

- Legal Custody

- Physical Custody

- Child Support

Sample Decree. Have you ever seen a divorce decree? You are free to check one out. I have highlighted all the sections that are variable in divorce cases. We don’t pretend that we draft every one from scratch. We use standard forms that we have developed in our years of practice. This is a tried and true format that has all of the required boilerplate language required by the law.

Property Division

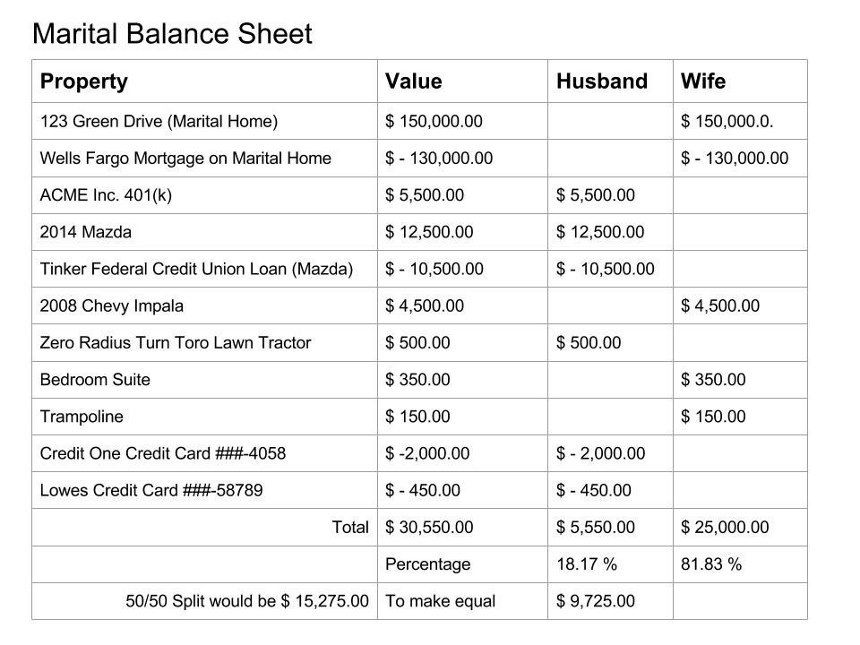

We suggest that you put together a Marital Balance Sheet. You can then use the marital balance sheet to fill out your Client Report. Think of the Marital Balance Sheet as your rough draft.

Marital Balance Sheet

A marital balance sheet is a way to show what property exists and how much of it each party is getting.

There are three (3) steps

Step 1: Identification

You need to figure out what you own and what you owe. This should be easier for you than it is for anyone else except for perhaps your spouse. You should simply sit down and make a list. We suggest doing this in a marital balance sheet. We show you an example below

Step 2: Valuation

Now, you need to assign values to the stuff. For anything that has a statement such as a 401(k) or a credit card, this is easy, read the statement and put in the number. For high value items like houses or cars, this might be harder, but there are many tools to help you estimate the value. Valuation is what people fight over the most in court, but it is usually because no one knows what the stuff is worth.

Step 3: Division

The last step is to divide the property between the two spouses.

Equitable Division

Most judges try to divide the property equally. The law says the division must be fair and equitable. This can mean it doesn’t have to be a 50/50 split, but most judge’s try to make it as even as possible. You should try to get as close to 50/50 as possible.

Tip: If you are going to sell an asset and split the proceeds then it is fair to award 50 % of the value of each asset to each spouse in the marital balance sheet.

Sample Marital Balance Sheet

Look at the marital balance sheet. The parties have not divided their property equally. You can see that the husband is receiving only 18.17 % of the property. He would need an additional $ 9,725.00 added to his column to make it an even split. In this case, the wife is keeping the house. The court would most likely require that she pay $ 9,725.00 in cash to the husband. She would likely do this by refinancing the house and paying him at closing.

Vehicles, Bank Accounts & Personal Property

Almost everyone who goes through a divorce has cars, bank accounts, and other stuff. All of this stuff is called Personal Property, and is just the stuff that we own.

Vehicles

Car should be identified by their make, model, and VIN. Most newer cards have loans. The car and the loan should not be split, meaning that we recommend that if you get a car in the divorce you should be the one who is responsible for paying the loan. Also, we recommend that if the car has a loan on it in both of your names then whoever receives the car in the divorce should be required to refinance the car into only their name. If they cannot refinance then the court should require them to sell the car and pay off the loan. We assume that the car loans should be refinanced solely into the name of the person who receives it in the divorce.

Bank Accounts

Bank accounts cover any depository account you and your spouse may have with a financial institution. We recommend that you and your spouse should remove each other from each of your bank accounts so that each of you is the sole owner of the account that you own. We assume that bank accounts should be awarded to the person in whose name it is held, if the account is a joint account and not awarded to one person or another then it won’t be split after the divorce.

Personal Property

Again, this is all the stuff that you own that isn’t cover elsewhere in this guide or the client report. We recommend that you list and describe any personal property that is very important to you or very valuable that you want to ensure that you keep after the divorce. We assume that before the divorce is granted that you and your spouse will have moved into separate homes and taken with you all of the personal property that you wish to keep.If you have not done so, then you will need to list the personal property that you wish to take with you when you separate.

Real Estate

We assume that your real estate is owned by both spouses and the property is titled in both of your names. We also assume that if there is a mortgage loan on the property that the mortgage is also in both of your names.

Method 1: One Spouse Keeps the House

We assume that if you are (1) awarding the property to one spouse and (2) the mortgage loan is in both names, that the spouse who gets the real estate will be required to refinance the mortgage loan into his or her own name within ninety (90) days of the decree. If the spouse receiving the house cannot refinance it then they will place the house on the market at a price as recommended by a qualified real estate agent and sell it.

We assume that if the spouse who keeps the house will pay the other for their equity that they will do so within 90 days of the Decree and this will be secured by a lien on the property which will be released when the money is paid.

We also assume that you and your spouse agree on the exact amount of money that will be paid for the equity in the house.

Method 2: Sell that thing

We assume that if you and your spouse are going to sell the house and divide the proceeds after paying all the costs that you will split the proceeds equally.

We also assume that while you wait for the house to sell you both will pay the mortgage payment equally.

Method 3: Custom Method

We DO NOT recommend any other method of disposition other than those two described above. It would be folly, and should be avoided. However, we have been doing this long enough to know that you and/or your spouse may have other plans. We strongly urge you to reconsider, but should you wish to arrange a different disposition of your property then please contact us.

Retirements

We assume that you and your spouse will each keep any employer-based retirement accounts that you own. If you want to divide these then you will need a special retirement division order. We can draft these but it is at added cost that is often equal to the cost you have already paid for the divorce.

If you have a retirement you wish to divide then please indicate which one below.

401k and Non-military Pensions

In the case of 401(k) and State and Private Pensions you will need to speak to your Office of Personnel Management, Human Resources or Payroll department to obtain a Qualified Domestic Relations Order Divorce Packet. We need the Rules and Procedures Packet and the QDRO Template. Every Retirement Plan has their own specially required court order and we have to draft the order to match the requirements of each plan.

Military Pensions

Military retirements have their own special rules, and we have all the necessary forms to handle the division of these.

IRAs

IRAs can be divided as bank accounts and they should be listed in the bank accounts section and they do not require an additional fee to divide.

Debts

Your debts must be divided as well as your assets.

We recommend that all joint debts must be divided and we must designate who is going to pay the debt in the decree. We also recommend that if the debt is secured by a piece of property such as a mortgage or a auto loan that the debt should follow the asset. This means that if the Mazda has a loan on it and your spouse gets the car that he or she should pay the loan as well. We DO NOT recommend that secure loans and their assets get split. This causes one party not to pay and then the repo man comes and takes your car without your knowing it is behind.

Joint Credit Cards

We assume that if someone agrees to pay a joint credit card debt then they will close the joint account so that no more charges will be made and/or they will transfer the balance to a new credit card that is solely in their name. We will order this in the Decree unless told not to do so.

Alimony

Alimony is not very common in uncontested divorces. It does happen from time to time, but we don’t really like it. It is complicated and makes a lot of assumptions that we can’t address in most uncontested decrees. If you can, it is best to cut financial ties. But if you cannot we can order alimony but you will need to be clear about what you are doing.

In Oklahoma Alimony is based on (1) one spouse’s need and (2) the other spouse’s ability to pay. The goal of alimony is to help the financially disadvantaged spouse readjust to single life.

We DO NOT recommend that alimony go on forever.

A good alimony award must have:

- Start Date

- Monthly payment amount

- End Date

We assume that you wish to have all the grounds for termination and modification apply from Oklahoma law. This includes the reasons stated in Title 43 O.S. Section 134.

Here is sample award:

The Respondent shall pay to the Petitioner support alimony in the amount of sixteen hundred dollars ($ 1,600.00) per month for one hundred forty-four (144) months for a total amount of two hundred thirty thousand four hundred dollars ($ 230,400.00). The award of support alimony in this case is made pursuant to Title 43 O.S. § 134 and is subject to modification and/or termination according thereto.

Child Issues

If you have children, then you must lay out the plan for providing for the care, custody and support of your children.

The issues are:

- Legal Custody

- Physical Custody

- Child Support

Legal Custody

Legal custody is the decision making authority. It comes in two varieties Sole Custody and Joint Custody. Joint Custody requires that the parents be able to cooperate together to make decisions for their children.

We assume that you and your spouse wish to share Joint Legal Custody because you are cooperating in the divorce.. Also, we assume that neither of you will be superior to the other in your custody agreement. You will discuss all major decisions related to the children. We assume that if you are not able to agree that you will seek out mediation and attempt to resolve your disagreements as mature and capable adults.

Physical Custody

Physical Custody is the schedule that you and your spouse will use to divide the children’s time between you. It is best no matter how much you agree now to put together schedule for the decree that you can follow in the case of disagreement in the future.

The physical custody schedule should be laid out in the three (3) schedules:

- Regular Schedule

- Summer Schedule

- Holiday Scheduled

Regular Schedule

There are several standard schedules used for the regular schedule. Here are some suggestions.

Method 1

Equal Time: “The children shall spend approximately equal time with both parents. The parties shall alternate custody from week to week with the exchange occurring on Sundays at 6pm”

Method 2

Standard Visitation: “The Mother will have custodial time with the children every other weekend from Friday after school or daycare until 6 PM on Sunday. All other time is reserved for the Father.”

Method 3: Custom

You are free to invent your own schedule whether it be from Thursday to Monday morning of every other week or whatever. We DO NOT recommend that your kids go back and forth every other day or even in the the 2-2-3 arrangement (M-T,W-Th, F- Sun). It is hard on kids to always be moving around and it will be hard on you too.

Summer Schedule

The summer schedule is during the summer when the kids are not in school.

Method 1

We assume that parent will keep the regular schedule through the summer.

If this is the case then each parent has the right to take the children on vacation in the summer upon reasonable notice to the other for up to two (2) weeks no matter what the visitation schedule.

Method 2

If the parties do not keep the regular schedule then we assume that in the summer the parties will share equal time with the children from week to week or according to the standard schedule with is listed herein and rotates every two weeks. .

Method 3:

Custom Schedule.

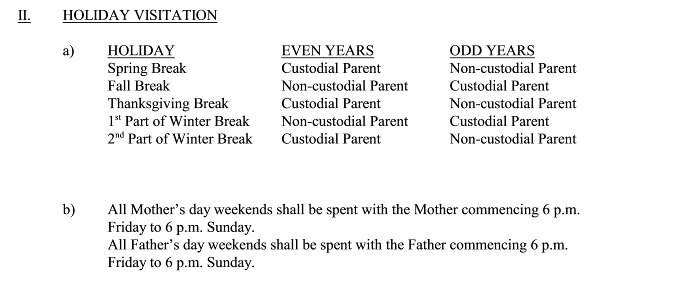

Holiday Schedule

Method 1

Standard Schedule. The standard schedule tried to alternate the holidays between the parents in even and odd years. It is pictured next to this text.

Standard Holidays

Method 2: Custom Schedule

You are free to come up with another schedule to handle the holidays or even include holidays that are not in the schedule such as Easter or Halloween.

We DO NOT recommend that you split the day of the holiday in the schedule. You certainly may do so by agreement but it is virtually impossible to enforce if you put it in the Decree and is certain to create a great deal of dissatisfaction and stress. In our experience parents who need a court order to tell them what to do are not able to successfully coordinate on holidays in a way that is good for the children or each other.

Changes after the Decree

You are free to change things by agreement!

Even after the divorce is entered you and the other side may change the schedule by agreement. The importance of the schedule we put in the Decree is that this must be the schedule you are willing to live by if you and the other parent are unable to agree. The court will expect you and the other side to follow the schedule in the Decree if you two cannot agree.

Child Support

Method 1: Deviation and Agreed Amounts

Many people agree to an amount of child support or to no child support at all. They usually do not use the state guidelines.

Method 2: State Calculator

We can use the state guidelines to calculate the amount of child support. We have to have both parties’ incomes

Mandatory Guidelines

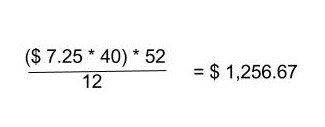

State law requires that we prepare a set of state guidelines no matter what you and your spouse may have agreed to. This means we have to have the proper inputs. You need to provide to use the information in the table below. If you are unemployed and not disabled then your income cannot be less than minimum wage for a 40 hour work week, which is $ 1,256.67 per month.

Tax Exemptions

We assume that you and your spouse will share the tax exemptions. In the case of an odd numbers of children (1,3,5) you two will alternate the right to claim the exemption(s) from year to year. In the case of even numbers of children (2, 4, 6) then each will claim an equal number of child. One is an odd number.

Income Calculations

Child support is based on gross income. This means the total amount that you make before taxes or deductions. It is figured on a monthly basis. This is rather silly since no one calculates their income this way. The math isn’t that hard though even though there are a variety of methods.The court has the choice to use:

- Your actual income

- A three year average of your income

- A number selected by the court if the judge thinks you aren’t making enough money

Most cases use actual income, and there are three (3) methods for calculating income:

- Wage Method

- Paycheck Method

- Annual Method

I think it will held to talk about calculating income because it is no exactly intuitive.

Method 1: Wage Method

Let’s say you may $ 7.25 per hour and work 40 hours per week. The formula looks like this:

Wage method.

As you can see above we have multiplied the wage by the number of hours per week and then the number of weeks. We then divided the figure by twelve months. This gives us the monthly amount.

Method 2: Paycheck Method

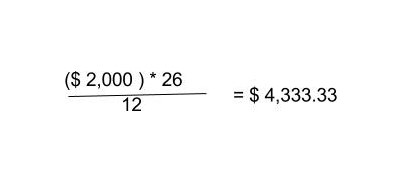

You use the same formula above with some modifications. Let’s same that your paystub shows that you make an average of $ 2,000.00 every two weeks. Then it means that you make $ 52K a year, and thus $ 4,333.33 per month.

Paycheck Method

Remember how often you are pay determines what number goes in the formula.

Weekly = 52 pay periods per year

Biweekly = 26 pay periods per year (as called “every two weeks”)

Semimonthly= 24 periods per year

Method 3: Annual Method

The annual method is the easiest. You just add up everything you made in a year. Maybe this is as simple as looking at your W-2. You then divide it by 12 to get your monthly average. If you are looking at a W-2 you should us the Federal Gross Taxable Wages box.

A note on self-employed income. You may have noticed that the top three methods above are for employed people. If you are self employed the formula is a bit different. It is your “gross receipts” minus your “reasonable business expenses”. The thing is that reasonable expenses exclude depreciation and some other expenses that may be applicable to taxes but not to child support.

Child Expenses

The child support guidelines require that we divide the cost of certain expenses related to your children.

We recommend that you pull the documents and calculate the expenses for your children. These two main expenses are Childcare and Health/Dental/Vision Insurance. These expenses should also be monthly, so you need to make sure that the figure we get is the monthly cost.

Childcare is annualized. This means you calculate the amount of childcare paid for the whole year and then divide it by 12. This will give you the total amount. Let’s say your childcare is $ 150.00 per week. The formula looks like (150 * 52)/12 = $ 650 per month.

Health Insurance expenses are supposed to be calculated for the children only. This means you may have to subtract the cost of employee coverage from the total cost to determine the cost for the children only. You should request the benefits forms from your employer and base your number off of the correct figures.

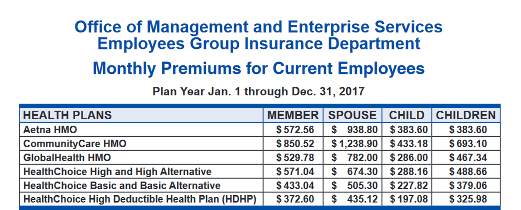

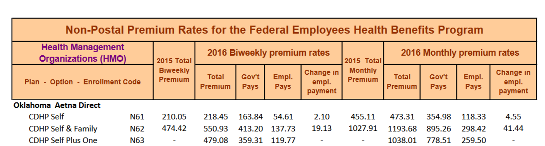

Some health plans make it easy. In the State Benefits plan below you can easily see that the cost for Health Choice Basic for two children is $ 379.06.

Employee + Children Plan

Method 1: Employee + Children

Other plans combine the costs in their charts. For example let’s say you pay for health insurance every two weeks when you get your pay check. The plan may say the cost for the employee is $ 50.00, $ 150.00 for employee + children. This means we subtract the employee cost from the employee + children cost to equal $ 100. This means the children’s cost is $ 216.66 per month. ((100-50)*26 )/12 = $ 216.66.

Employee + Family Plan

Method 2: Employee + Family

Some plans are Employee plus family which means the entire family is covered, sometimes this includes other children or a spouse. This means the cost for the children depends on the number of dependents covered. For example, let’s use the chart below. In this case Oklahoma Aetna Direct costs $ 210.05 biweekly for employee but $ 474.42 biweekly for employee + family. So we subtract the employee cost from the employee + family cost so, 474.42-210.05= $ 264.37. Let’s say that there are three children, and only two of them are from this relationship that is at issue. This means we divide the family cost by the number of dependents, i.e. 267.37/3= $ 88.12. We then multiple by the number of kids in this case, and figure out the monthly cost. ((88.12*2)*26)/12= $ 381.85.

Other Factors

There are other factors that affect child support although they are much less often. You should inform your lawyer if any of the following applies to you or your spouse:

- You pay child support on other children not in this case,

- You have a child that lives with you that you support who is not a child from this case,

- You pay support alimony in another case,

- You or your children have received benefits from DHS, or

- Your children receive social security benefits based on one parent’s disability.

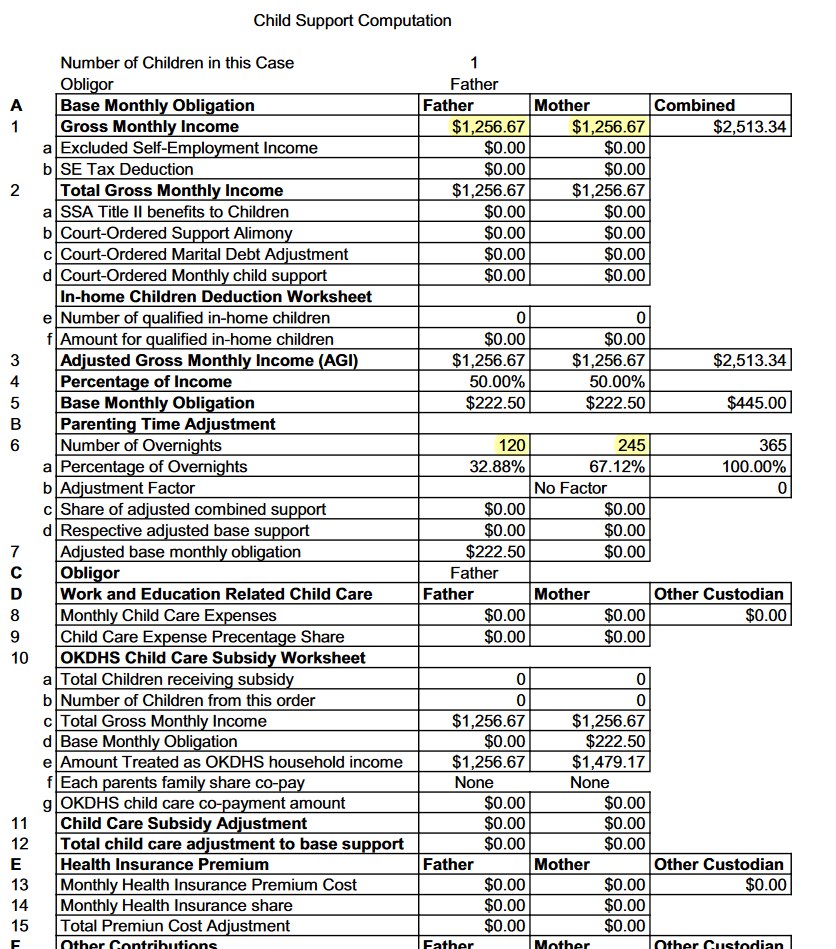

Child Support Computation

When calculating child support we strong warn you against the “garbage in / garbage out” maxim. You must put the right numbers in to get the right result.

We will handle doing your computation. Once we have all the correct inputs we put them through the Oklahoma State child support guidelines computation. I cannot emphasize enough that child support is rather complicated. This should be clear by looking at the screen capture from our spreadsheet used to do the computation:

Child Support Computation

Pictured here is only one half of the 113 rows in just one page of the spreadsheet. There are also an additional 5 pages in the notebook. This is far more compressed that the 8 page excel sheet used by Oklahoma Child Support Enforcement.It is somewhat of a joke, but much like a Jedi completes a section of his training by making his own light saber, unless you are competent to program your own child support computation you should leave the computation to the professionals.

Final Thoughts

Those are all of the main things that you need to consider in putting together your divorce.

You should use this guide in conjunction with your Client Report. It will help you give us the right information and make sure we have the best facts from which to assemble your divorce.

We want the best information and the more you understand the better.

This information is provided courtesy of Evan Taylor. Evan Taylor is a lawyer practicing Divorce and Family Law in Norman, Oklahoma. Contact Evan here.